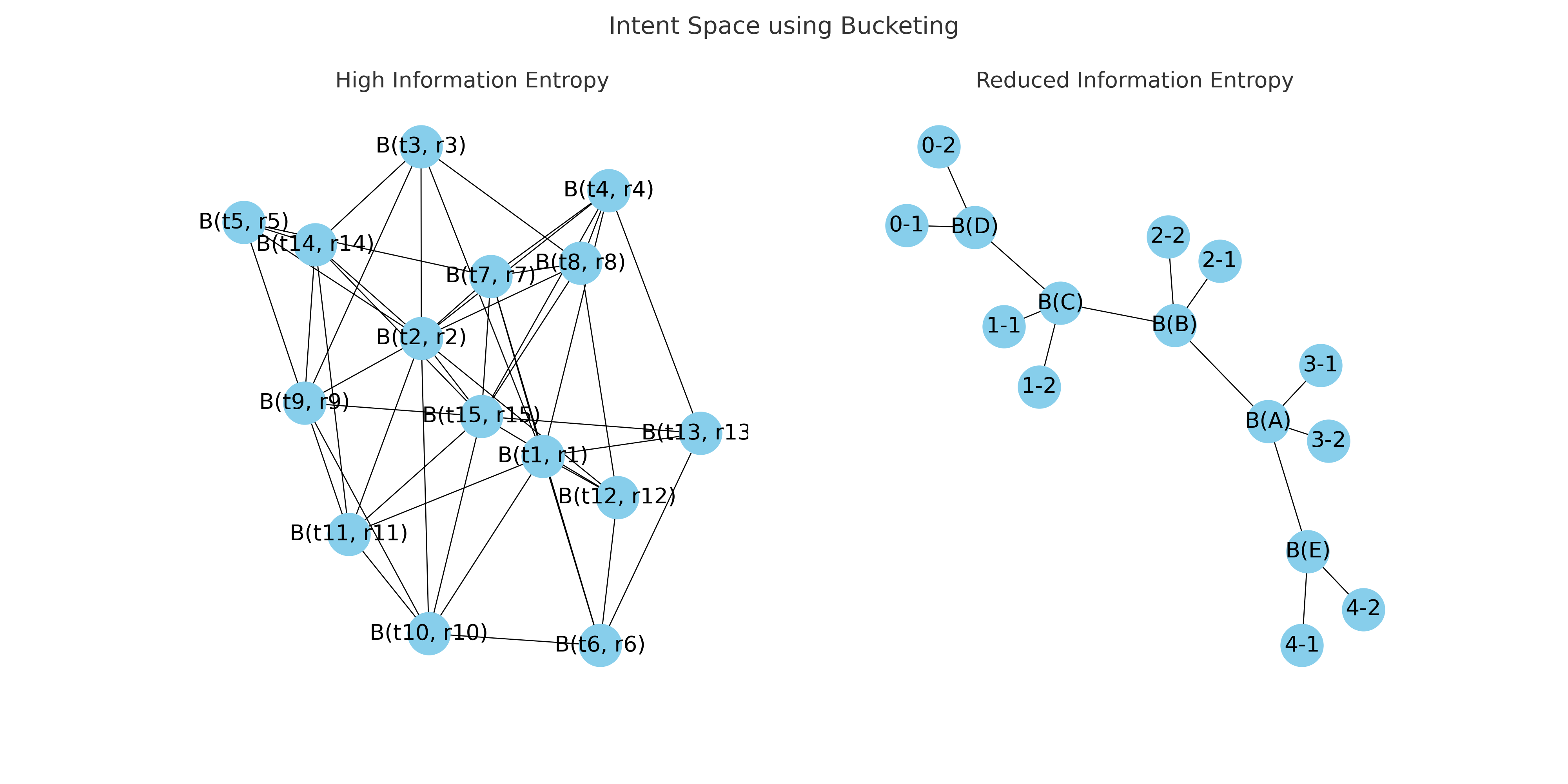

Bucketing

Buckets are an abstraction with a set interest rate and set term. An arbitrary amount of buckets can exist in the Intent Space. Lenders choose to either take the market by selecting an existing bucket or make the market by creating one. Though lenders can create their own buckets by calling the contracts, at launch, the protocol will list two buckets.

Bucket Parameters

Term(Duration): Term for a selected bucket is static. All intents within a bucket have the same term.

Interest Rate(APR): Similarly, interest rate is fixed for a chosen bucket. Interest rate is charged on the borrowed asset in borrowed asset units based on the term.

How does Bucketing help?

Buckets reduce the variables from the Intent Space making it easier and competitive for users in the ecosystem improving price discovery. Intent Space without buckets mirrors a complex systems with high information entropy. This leads to lenders being scattered across multiple nodes. with their own terms(t) and rates(r). Buckets reduce information entropy as lenders lend and compete in existing buckets.

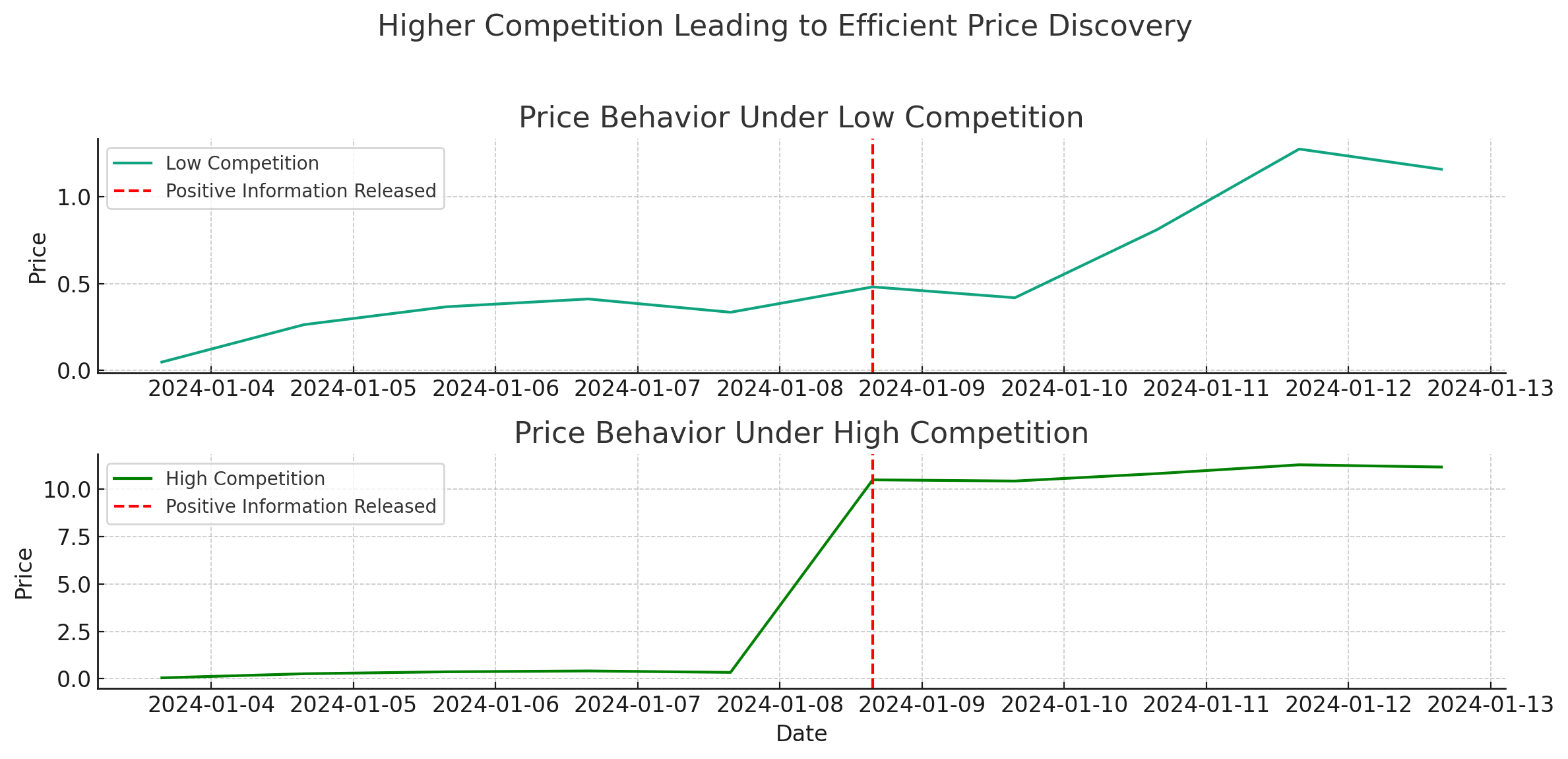

Price Discovery: How does it work?

Lenders select a bucket and enter a fixed price that they are ready to lend against. Lenders can price the parameters of the bucket by adjusting the lend price(read Interest Rate <> Lend Price Invariant) to achieve a stable equilibrium. This leads to:

Efficient Price Discovery: is achieved through higher competittion as lenders compete to be at the top-of-the-stack. Competition natively baked into the protocol mechanics as borrowers are automatically matched to the most aggressive lenders first. From a efficienct market hypothesis perspective, markets are "informationally efficient," meaning that asset prices in these markets reflect all available information at any given time. This hypothesis relies heavily on the idea of competition among market participants.

Higher Liquidity: as lenders' intents are nudged to supply into existing markets, liquidity concentrates in tight ranges. Combined with clear hypothecation of assets and market-driven parameters, Buckets make it easier for lenders to price risk. This achieves a financially stable equilibrium where lenders can price the loans both efficienctly and accurately. Leading to a better lending experience and risk management.