Fixed Lend Price

SUMMARY

Fixed Price Lending is the deterministic lending based on lender underwritten collateral valuation. Fixed Price Lending is derived from Interest Rate <> Lend Price Invariant and it allows for higher granularity, increased competition amongst lenders, and accurate pricing of risk.

What is Fixed Price based Lending?

Fixed Price Lending involves lenders setting a specific price at which they are willing to lend, based on their own valuation of the collateral risk. Instead of optmistically accepting the market/pool parameters, MethLab Lenders enter the Fixed Lend Price they are ready to offer for the given terms to indulge in Fixed Price based Lending. This is deterministic, granular and defined as lenders make the market by underwriting at their own terms.

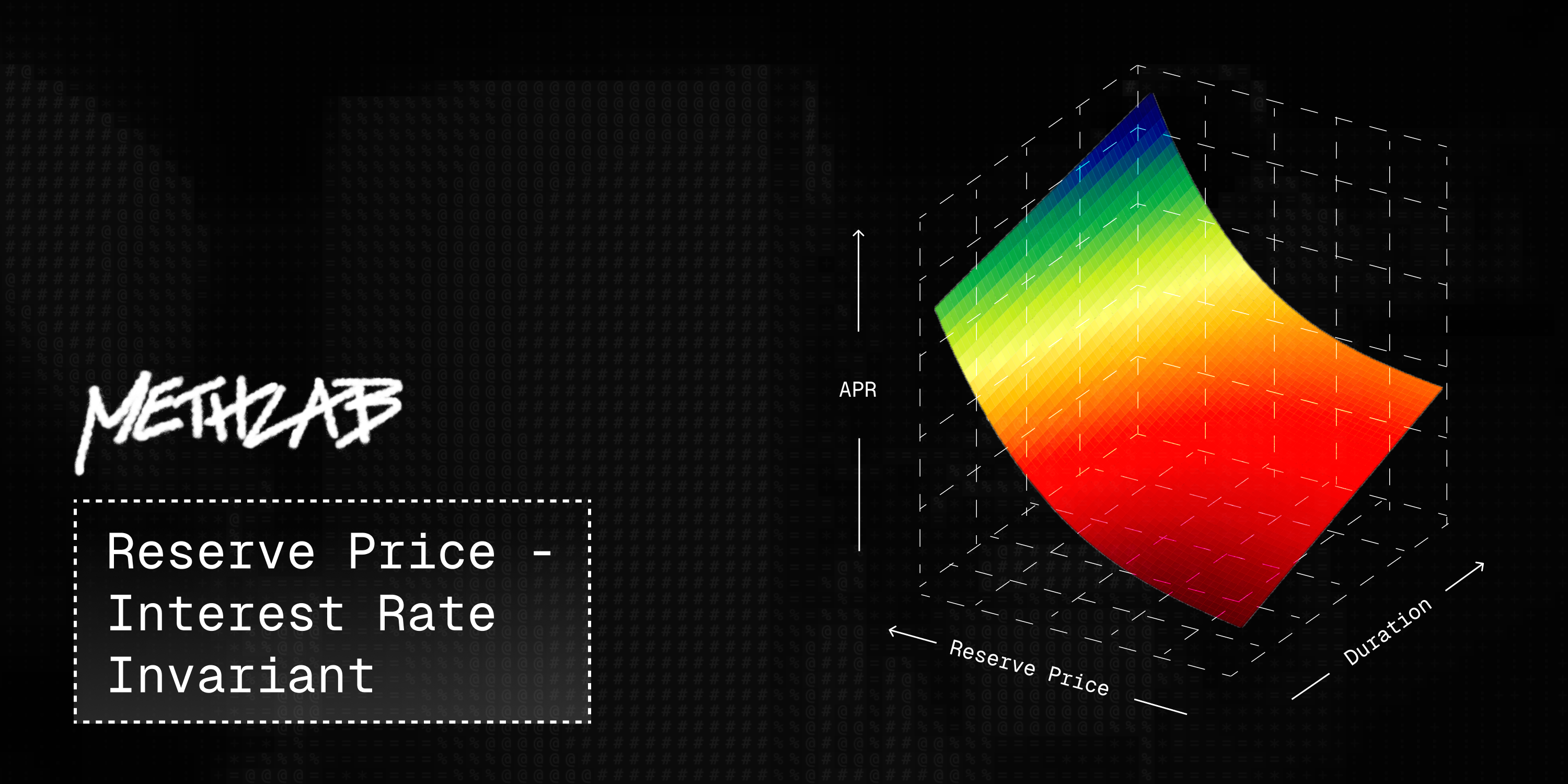

Interest Rate - Lend Price Invariant

The Interest Rate - Lend Price Invariant maintains that a fundamentally stable equilibrium exists between the interest rates and lend price lenders offer. This stable equilibrium ensures that lenders can offer varying Fixed Lend Prices based on market dynamics and individual risk adjustments while still maintaining a consistent relationship with a chosen Interest Rate.

The Invariant

Lend Price - Interest Rate Invariant fundamentally establishes that at a given time,

What does it mean?

Dynamic Loan Parameters

MethLab enables dynamic adjustments of loan parameters, such as interest rates and term, rather than using fixed parameters. This dynamic approach allows the system to adapt quickly to changing market conditions, promoting flexibility and responsiveness. Traditional platforms often rely on static parameters derived from simulations or contributor decisions, are prone to recognition and action lag. that can cause loss of user funds.

Concentration of Liquidity

Liquidity concentration has flywheel effects that increases competition and reduces the transaction costs. The Invariant helps in concentrating liquidity by simplifying and guiding loan parameters. This concentration facilitates easier matching of lenders and borrowers, while being able to offer better user experience for both lenders and borrowers.

Flexibility and Market Responsiveness

The Invariant's stability enables swift adjustments to loan parameters, ensuring that the system remains responsive to dynamic market conditions. This benefits both lenders and borrowers by providing more favorable terms at any given point of time.

Enhanced Lender Risk Management

MethLab's dynamic model offers Lenders to granularly underwrite each position allowing for more favorable terms tailored to current market conditions. This personalized approach enhances the borrower experience compared to platforms with static parameters.