For Liquidity Providers

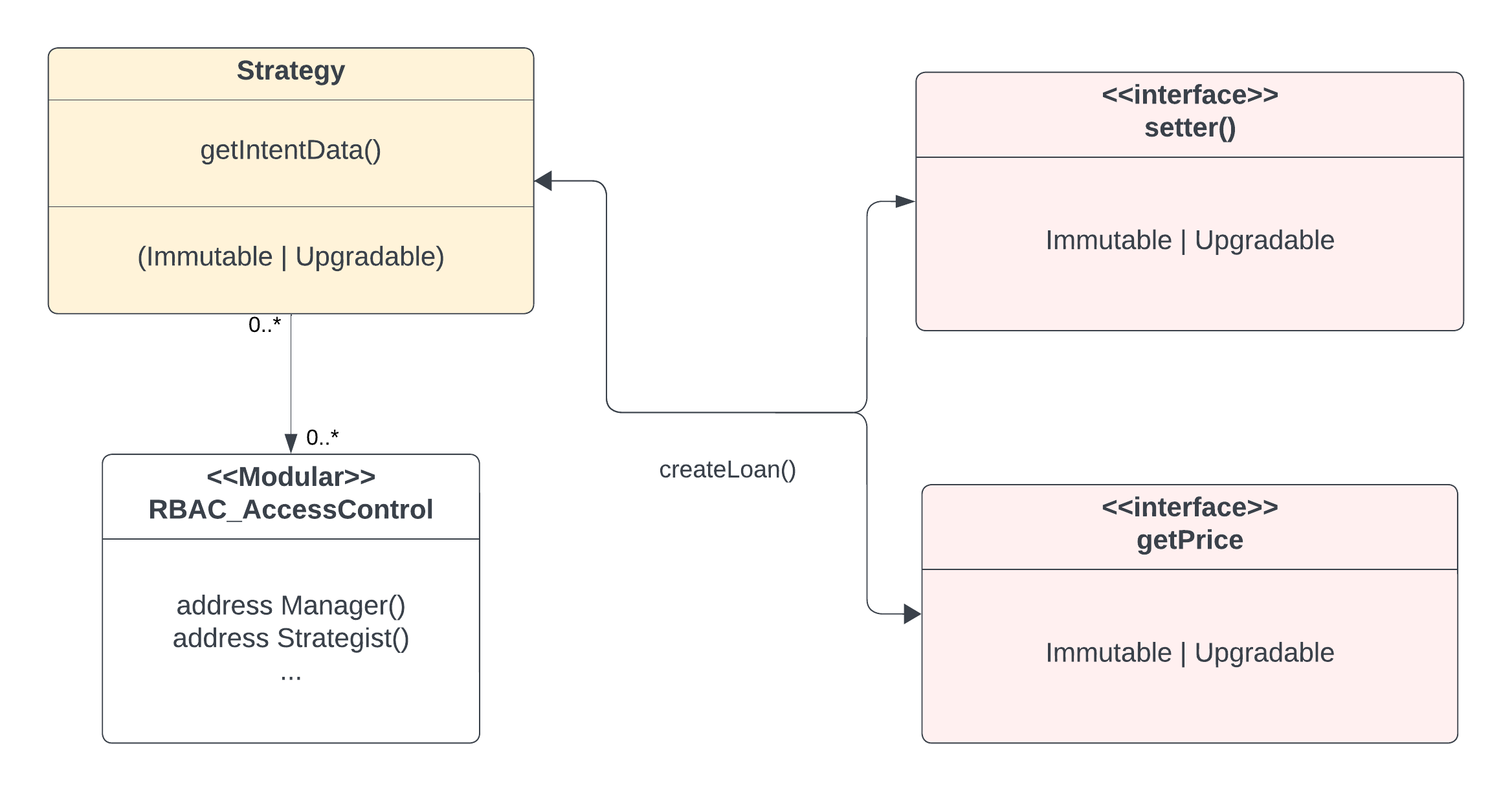

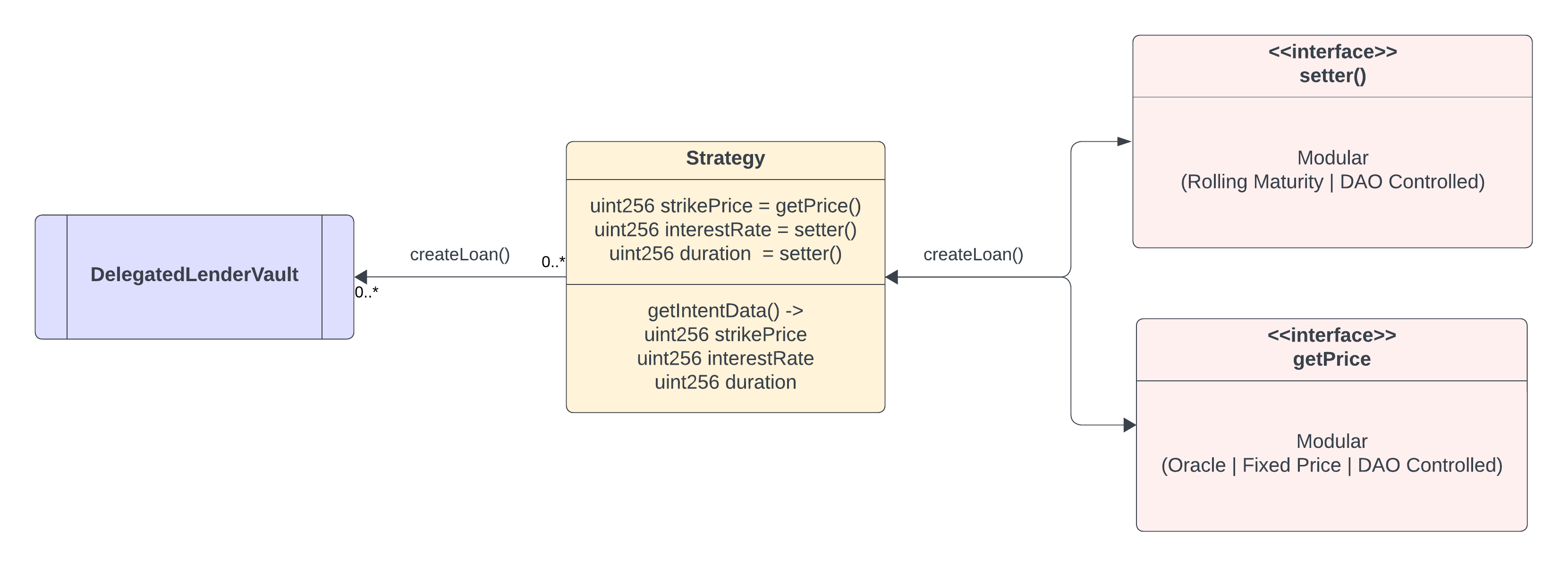

To supply on MethLab, Liquidity-provider deploys a DelegatedLenderVault that delegates to the initialised Strategy contract. Strategy contract modularizes the logic of lending terms and outputs the Borrow Price, Interest Rate, Duration for a 'Loan' to be created.

Strategy contract abstracts and automates the process of managing the lending terms. Strategy contract can be immutable to ensure decentralisation or upgradable to ensure flexibility.

The liquidity is deposited into the vault and anyone can create a loan by depositing the collateral. The loan is created by the vault and the collateral is transferred to the Loan contract. Vault holds all the forfeited collateral and any available liquidity.