Liquidation-free

SUMMARY

MethLab is liquidation-free. A paradigm shift from traditional DeFi lending mechanisms.

DeFi Lending and Liquidation Risk: Status Quo

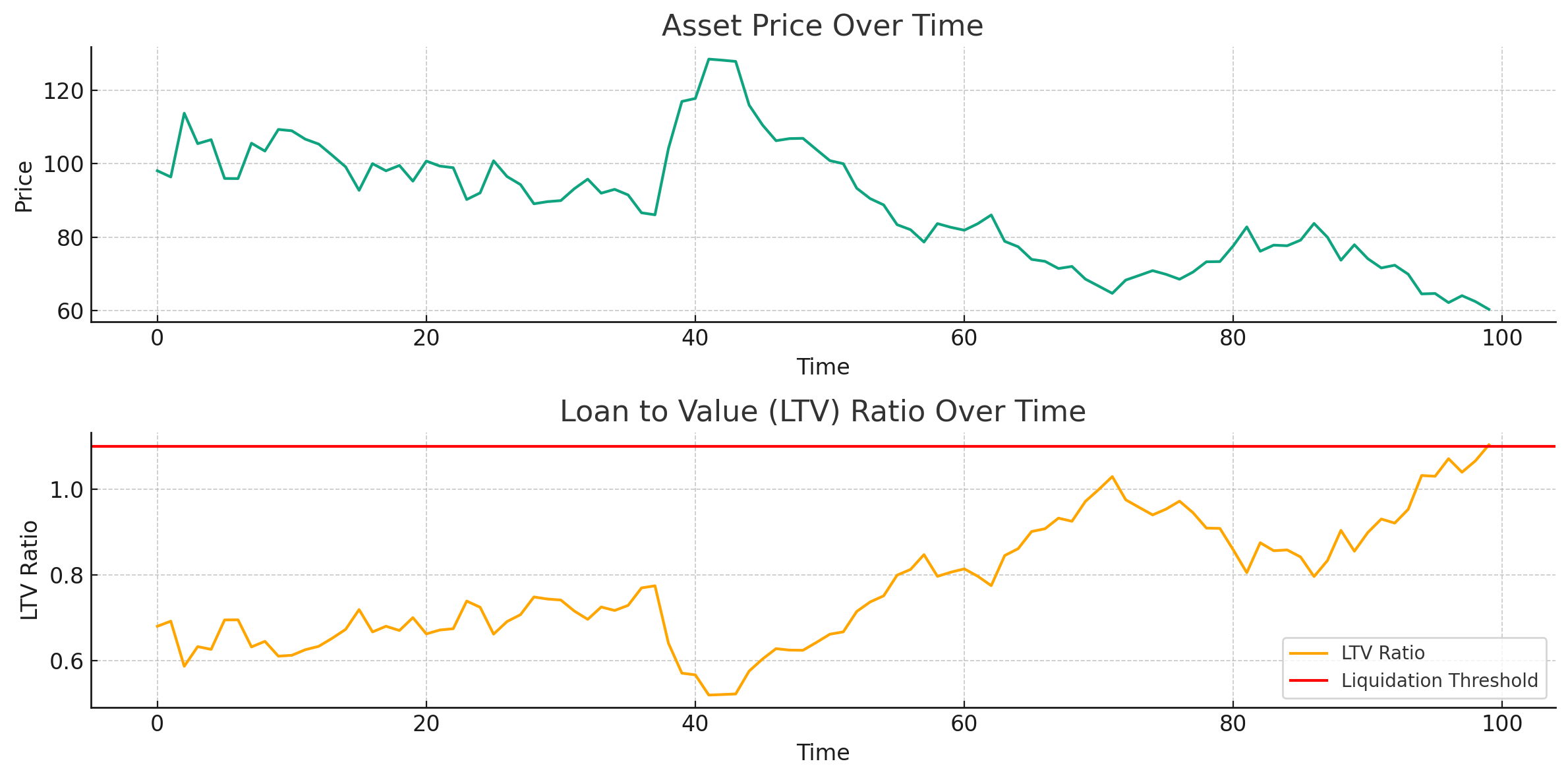

Users borrow funds by providing collateral. The loan health is monitored using a loan-to-value (LTV) ratio between the borrowed assets and collateral assets. If the collateral value drops below a certain threshold (LTV ratio) as set by the protocol, the contracts trigger a liquidation. Protocol then sells the borrower's collateral to recover the lender's assets. Price based liquidation can create a vicious chain-reaction of selling, potentially causing a market downturn and low on-chain liquidity.

MethLab

MethLab's architecture is liquidation-free.

Instead of forcibly selling collateral when its value drops, the system keeps holding the collateral. The borrwer can repay the borrowed amount anytime before the expiry to claim it back in full.

Liquidation-free flow in MethLab

Non Liquidatable Leverage

Traditional DeFi lending models can be intimidating for borrowers due to the constant threat of liquidation, especially during market volatility. MethLab users can open non-liquidatable-leverage positions even in turbulent market conditions, assured that their collateral won't be forcibly sold, as long as they repay back.

This assurance aims to provide borrowers with greater confidence in engaging with the market without the fear of abrupt and involuntary liquidations affecting their collateral.

How does it work?

Let's understand using an example.

Borrower A borrowes 1500 USDT for 30 days at a borrow price of 1500 USDT by depositing 1 mETH. If the current price of ETH is 2000 USDT, this translates to

Once the loan is expired, and the borrower loses the right to claim the collateral back. The lender can call the seizeCollateral function to reclaim the escrowed collateral.